Has your business’s business interruption or civil authority insurance claim been denied?

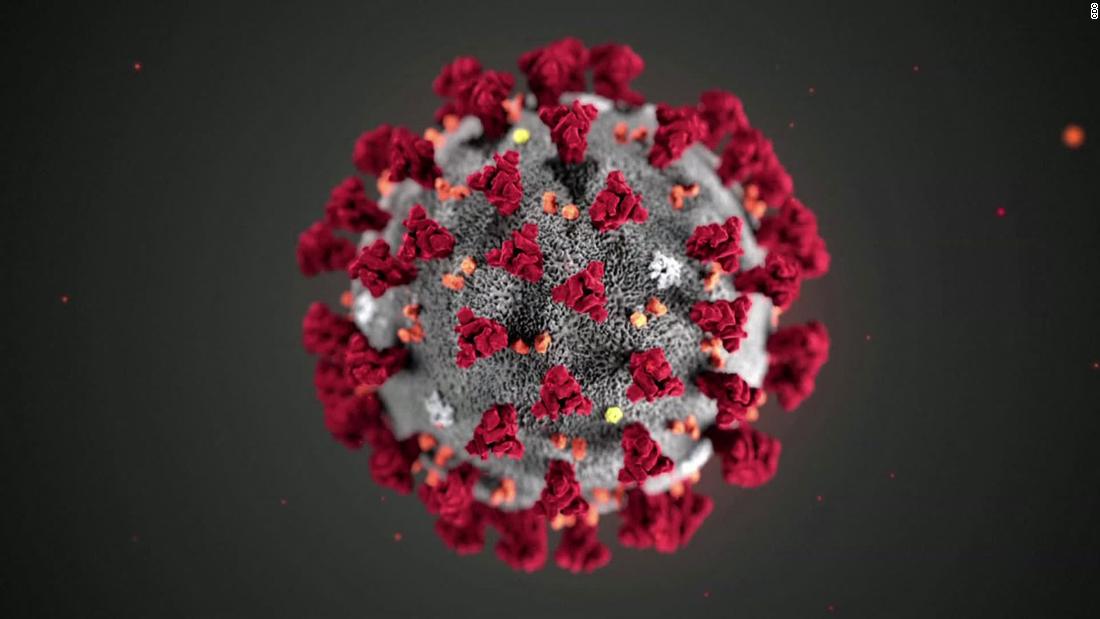

Neumann Law Group has a proven track record challenging insurance coverage denials. Today, more and more businesses are suffering extensive losses, either directly from the corona virus, or from governmental action shutting down operations to mitigate the public health risk. Many businesses have paid insurance companies premiums for years to ensure protection in the event of a business stoppage by purchasing business interruption and civil authority policies or riders. Now, when small businesses need the most help, insurance companies are not providing much needed assistance.

Nationwide, almost all insurers offering business interruption coverage or civil authority coverage have denied claims related to COVID-19. The two types of policies are interrelated. Business interruption coverage allow companies to hedge against certain losses when the business suffers physical damage or loss that interferes with its ability to operate. Civil interruption coverage generally allows recovery when a civil authority issues an order closing a business or interfering with normal operations.

First and foremost, if you don’t know whether your business has such coverage, call your agent and find out. Most policies require the insured to submit claims promptly, so making a timely claim is critical. The types of injury upon which business have filed claims include lost income due to business closure, lost income due to public knowledge of infections on premises, costs of sanitization and employee testing, and a host of other claims specific to particular businesses.

Once a claim is made, however, do not anticipate swift payment on your claim. Insurers are relying upon a number of different theories to deny interruption claims. Although specific denials vary based on the insurance policy and the business making a claim, one of the most prevalent grounds denial involves a requirement that the interruption is caused by a physical impact. Insurers argue that the introduction of a pathogenic particulates do not constitute a direct physical loss or damage to an insured’s property. Insurers are also relying upon policy exclusions, including injuries related to the loss of the company’s market, inability to use company assets, and injuries caused by delays rather than interruption.

In response to the mass denials—there are reports of insurers simply placing blanket denials on their website—many businesses are electing to sue. Lawsuits are proceeding in California, Texas, Illinois, and Pennsylvania, all based on slightly different theories regarding many different types of businesses. In one instance, a complaint was filed seeking coverage under a “Pandemic Event Endorsement” which specifically identifies SARS and other corona virus mutations and variants. The insurer argues that COVID-19 is not a variant or mutation of the SARs-CoV disease.

Insurance companies are not only relying upon insurance policy definitions and exclusions. They argue the public interest will not be served if large swaths of the insurance industry become insolvent due to paying out claims in record volume. While certain lawmakers in New Jersey, New York, Ohio, Louisiana and Pennsylvania have proposed legislation forcing insurers to provide some degree of coverage for COVID-19 losses, modification of existing contractual relationships is barred under the Contracts Clause of the United State Constitution.

Given the posture of the insurance industry and the unlikelihood of government intervention, business owners that have been denied coverage should turn to their legal counsel to review the specifics of their policy and circumstances. The attorneys at Neumann Law Group have decades of experience challenging insurance denials and stand ready to counsel companies that have been denied business interruption or civil authority insurance claims. Contact our office for a free consolation to see if your claim may have been improperly denied.

Benjamin Bryant, JD

Neumann Law Group